To make money, start by identifying your skills and exploring opportunities that match them. Create a plan and stay disciplined.

Making money requires strategic planning and utilizing your unique skills. There are numerous ways to generate income, ranging from freelance work to investments. Freelancing offers flexibility and can be a great way to use your talents for financial gain. Investing in stocks, real estate, or even starting a small business can also be profitable.

The key is to research and choose the right opportunities. Side hustles like blogging, affiliate marketing, or online tutoring can supplement your income. Remember, consistency and dedication are essential. Stay focused on your goals and adapt to new opportunities as they arise.

Introduction To Financial Success

Welcome to your journey towards financial success. This guide aims to provide you with practical steps to achieve financial stability and growth. Whether you are just starting or looking to improve your financial situation, this guide has something for everyone.

Importance Of Financial Planning

Financial planning is the foundation of financial success. It helps you set clear goals and create a roadmap to achieve them. Without a plan, managing your money can become chaotic.

- Budgeting: Creating a budget helps track your income and expenses.

- Saving: Setting aside money for future needs is crucial.

- Investing: Investing grows your wealth over time.

Financial planning also prepares you for unexpected expenses. It ensures you have a safety net during emergencies. With a solid plan, you can avoid debt and build wealth.

Benefits Of Multiple Income Streams

Relying on a single income source can be risky. Multiple income streams provide financial security and growth. Here are some benefits:

- Diversification: Reduces risk by spreading income sources.

- Increased Earnings: More income streams mean more money.

- Skill Development: Different jobs enhance your skills.

There are many ways to create multiple income streams. You can start a side business, invest in stocks, or take up freelance work. The key is to find what works best for you and stay consistent.

Consider the following table to understand different income streams:

| Income Stream | Description | Potential Earnings |

|---|---|---|

| Side Business | Starting a small business | High |

| Stock Investments | Investing in stocks | Variable |

| Freelance Work | Part-time projects | Moderate |

Creating multiple income streams takes effort. But the rewards are worth it. Financial planning and diverse income sources lead to financial success.

Setting Financial Goals

Setting financial goals is a key step in making money. It helps you track your progress and stay motivated. This guide will help you set both short-term and long-term financial goals.

Short-term Goals

Short-term goals are goals you want to achieve soon. These goals usually take less than a year to accomplish. They keep you focused and give you quick wins.

- Build an Emergency Fund: Save enough money to cover 3-6 months of expenses.

- Pay Off Debt: Focus on clearing small debts first. This will reduce your financial stress.

- Save for a Vacation: Set aside a small amount of money each month. This will help you afford a nice trip.

Long-term Goals

Long-term goals take more time to achieve. They usually take more than a year. These goals help you build a secure financial future.

- Save for Retirement: Contribute to a retirement account regularly. This ensures you have money for your old age.

- Buy a Home: Save for a down payment. This can take several years but is worth the effort.

- Invest in Education: Save money for your or your children’s education. This can open up more opportunities.

| Criteria | Short-term Goals | Long-term Goals |

|---|---|---|

| Time Frame | Less than 1 year | More than 1 year |

| Examples | Build an Emergency Fund, Pay Off Debt | Save for Retirement, Buy a Home |

Budgeting Basics

Budgeting Basics are essential for anyone looking to improve their financial health. A well-planned budget helps you manage your money, reduce debt, and save for the future. This guide will help you understand how to create a budget and track expenses effectively.

Creating A Budget

Creating a budget is the first step to financial freedom. Follow these steps to get started:

- List Your Income: Include all sources like salary, freelance work, and investments.

- Calculate Expenses: Divide them into fixed (rent, utilities) and variable (groceries, entertainment).

- Set Financial Goals: Short-term and long-term goals will guide your spending.

- Allocate Funds: Assign a portion of your income to each expense category.

Tracking Expenses

Tracking expenses is crucial to ensure you stick to your budget. Here are some tips:

- Use Budgeting Apps: Apps like Mint or YNAB can help you track spending.

- Keep Receipts: Save receipts to monitor your spending habits.

- Review Monthly: Check your budget monthly to make necessary adjustments.

Below is a simple table to help you track your expenses:

| Category | Budgeted Amount | Actual Spent |

|---|---|---|

| Rent | $1000 | $1000 |

| Groceries | $300 | $320 |

| Entertainment | $150 | $200 |

Remember, the key to successful budgeting is consistency and adjustment. If you overspend in one category, reduce spending in another. Stay committed to your goals and watch your financial situation improve.

Credit: www.reddit.com

Saving Strategies

Effective saving strategies can help you build a solid financial future. By focusing on key areas, you can maximize your savings and be prepared for unexpected expenses. Here are some important saving strategies to consider.

Emergency Fund

An emergency fund is essential for financial security. It acts as a safety net for unexpected expenses like medical bills or car repairs. You should aim to save at least three to six months’ worth of living expenses.

To build an emergency fund:

- Set a monthly savings goal.

- Automate your savings.

- Reduce unnecessary expenses.

Having an emergency fund can prevent you from falling into debt during tough times.

High-yield Savings Accounts

A high-yield savings account offers better interest rates compared to regular savings accounts. This helps your money grow faster.

To choose a high-yield savings account:

- Compare interest rates from different banks.

- Check for account fees.

- Look for easy access to your funds.

High-yield savings accounts are a smart way to make your money work harder for you.

Investing Essentials

Investing can help you grow your wealth. Understanding the basics is crucial. This guide will cover essential aspects of investing. We will focus on stocks and real estate. Let’s dive in!

Stock Market Basics

The stock market is where you buy and sell shares. Shares are parts of a company. When you buy a share, you own a piece of that company.

Diversification is key. This means buying different types of stocks. It reduces risk. Don’t put all your money in one stock.

Research is important. Know the company before you buy its stock. Check its history and future plans. Look at its earnings and debts.

Use stop-loss orders. These protect you from big losses. You set a price to sell if the stock drops too much.

Real Estate Investments

Real estate is another way to invest. You can buy houses, apartments, or land. Real estate can give you steady income. You can rent out your property.

Location is very important. Good locations attract tenants. They also increase property value.

Maintenance is a must. Keep your property in good shape. This keeps tenants happy and attracts new ones.

Financing is crucial. Understand your mortgage terms. Compare different loans. Look for low-interest rates.

Below is a comparison table for stock market and real estate investments:

| Aspect | Stock Market | Real Estate |

|---|---|---|

| Liquidity | High | Low |

| Risk | Variable | Variable |

| Initial Investment | Low | High |

| Time Commitment | Low | High |

Both stocks and real estate have pros and cons. Choose the one that suits you best.

Credit: www.reddit.com

Building Passive Income

Building passive income is a powerful way to achieve financial freedom. It allows you to earn money without active effort. This section explores two popular methods: rental properties and dividend stocks.

Rental Properties

Rental properties can provide a steady stream of income. You buy a property, rent it out, and collect rent each month. Here are some benefits:

- Steady Cash Flow: Monthly rent provides consistent income.

- Property Appreciation: Property value may increase over time.

- Tax Benefits: Deductions for mortgage interest and property taxes.

Consider these steps to start:

- Save for a down payment.

- Research potential rental markets.

- Buy a property in a good location.

- Find reliable tenants.

- Manage the property or hire a manager.

Dividend Stocks

Dividend stocks can also provide passive income. These are shares of companies that pay dividends regularly. Benefits include:

- Regular Income: Quarterly or annual dividend payments.

- Potential Growth: Stock value may increase.

- Portfolio Diversification: Spread risk across various sectors.

Follow these steps to invest:

- Open a brokerage account.

- Research dividend-paying companies.

- Select stocks with a strong history of dividend payments.

- Invest and reinvest dividends for compound growth.

- Monitor your investments regularly.

Both rental properties and dividend stocks can help you build passive income. Choose what suits your financial goals and start today.

Side Hustles And Gigs

Side hustles and gigs are fantastic ways to earn extra money. They offer flexibility and can fit into your existing schedule. Explore different opportunities to find what suits you best.

Freelancing Opportunities

Freelancing opens up a world of possibilities. You can offer your skills and services online. Popular platforms like Upwork and Fiverr can help you get started. Here are some freelance jobs you can consider:

- Writing and Editing

- Graphic Design

- Programming

- Virtual Assistance

- Social Media Management

Freelancing allows you to work on projects you enjoy. You can set your own rates and choose your clients.

Online Businesses

Starting an online business can be very rewarding. It requires effort but can lead to significant income. Here are some online business ideas:

| Business Type | Description |

|---|---|

| eCommerce Store | Sell products through platforms like Shopify or Etsy. |

| Blogging | Write about topics you love and monetize your blog. |

| Affiliate Marketing | Promote products and earn commissions on sales. |

| Online Courses | Create and sell courses on platforms like Udemy. |

| Print on Demand | Design and sell custom merchandise without inventory. |

Starting an online business can give you financial freedom. It allows you to work from anywhere in the world.

Avoiding Financial Pitfalls

Managing your money wisely helps you avoid common financial pitfalls. Learning from mistakes and applying practical tips can save you from debt and stress. This section will guide you through common financial mistakes and offer effective debt management tips.

Common Mistakes

Avoiding financial pitfalls starts with recognizing common mistakes. Here are some frequent errors:

- Overspending: Buying more than you can afford leads to debt.

- Ignoring Budgets: A budget helps you track spending and save money.

- Not Saving: Savings provide a safety net for unexpected expenses.

- High-Interest Debt: Credit cards with high interest can spiral out of control.

Debt Management Tips

Effective debt management keeps your finances healthy. Follow these tips to manage debt:

- Create a Budget: List your income and expenses. Cut unnecessary costs.

- Pay More Than Minimum: Paying more reduces debt faster and saves interest.

- Consolidate Debt: Combining debts can lower interest rates and simplify payments.

- Seek Professional Help: Financial advisors offer strategies to manage and reduce debt.

Here is a table summarizing these tips:

| Tip | Benefit |

|---|---|

| Create a Budget | Tracks spending and cuts unnecessary costs |

| Pay More Than Minimum | Reduces debt faster, saves interest |

| Consolidate Debt | Lowers interest rates, simplifies payments |

| Seek Professional Help | Offers strategies to manage and reduce debt |

Continuous Learning

About learning, indeed, every serious individual who is interested in making money should continue learning. It makes you practice what you already learned and be up to date on anything new that is going around. In this section, we shall also learn how we can keep on learning.

Financial Education Resources

Financial education is the foundation of money-making. Here are some top resources:

- Books: “Rich Dad Poor Dad” by Robert Kiyosaki, “The Intelligent Investor” by Benjamin Graham.

- Online Courses: Udemy, Coursera, and Khan Academy offer excellent finance courses.

- Podcasts: “The Dave Ramsey Show” and “ChooseFI” provide practical financial advice.

- Websites: Investopedia and NerdWallet offer detailed financial articles.

Staying Updated With Market Trends

Understanding market trends helps you make informed decisions. Here are ways to stay updated:

| Method | Description |

|---|---|

| News Websites | Follow CNBC, Bloomberg, and Reuters for the latest updates. |

| Newsletters | Subscribe to financial newsletters like “Morning Brew” or “The Hustle”. |

| Social Media | Follow financial experts on Twitter and LinkedIn. |

| Forums | Join Reddit communities like r/personalfinance and r/investing. |

Regularly updating your knowledge can help you spot opportunities. It can also help you avoid pitfalls.

Conclusion And Action Plan

Embarking on a journey to make money requires clear goals and actionable steps. This section will wrap up our guide and provide a concrete action plan to help you achieve your financial goals.

Reviewing Goals

First, let’s revisit your goals. Are they specific, measurable, achievable, relevant, and time-bound (SMART goals)? If not, refine them. Make sure you know exactly what you want to achieve and by when. Write these goals down and place them where you can see them daily.

| Goal | Details | Deadline |

|---|---|---|

| Save $500 | Cut down on eating out | 3 months |

| Earn $1000 | Freelance writing | 6 months |

Implementing Strategies

Now that your goals are clearly defined it is time to activate strategies. In the process of achieving each goal, divide it into sub-tasks. It results to them being more manageable, which will make it easier to accomplish them.

Saving Money: The best way to do it is by documenting the amount spent on a daily basis. Minimize expenses using apps, whereby certain expenses are paid using the applications on the phone.

Earning Money: List things to do. Browse for self-employed jobs available online.

Investing: Venture in searching for low risk investment tools. Start with small amounts.

Schedule particular days of the week to dedicate the efforts on these tasks. Consistency is key.

Meet with your assessor on a weekly basis and go through achievements on the set goals.

Adjust strategies as needed.

Celebrate small wins.

If you will adhere to the said action plan, then you will be well on your way in achieving your financial objectives. Similarly, the last adage in the set is ‘Stay committed, and success will follow’ which simply means that one must always work hard and ensure he or she sticks to their goal in order to achieve success.

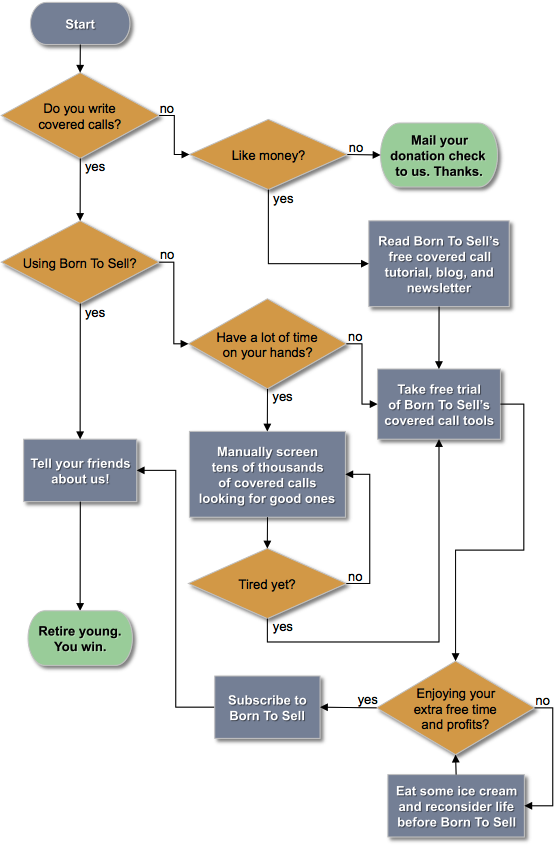

Credit: www.borntosell.com

Frequently Asked Questions

How Can I Make Money Fast?

Sell unused items online, offer freelance services, drive for ride-sharing apps, or complete online surveys for quick cash.

How Could I Be Making Money Right Now?

Start freelancing, sell handmade crafts online, or teach a skill virtually. Consider investing in stocks or starting a blog.

How Can 1 Make Money?

Start a blog, sell products online, freelance, invest in stocks, or offer consulting services. Create online courses.

How To Get Money In Runescape?

Earn money in Rune Scape by mining ores, fishing, woodcutting, or crafting items. Complete quests and sell loot. Engage in player trading.

Conclusion

Embarking on a money-making journey can be rewarding with the right strategies. Utilize these tips to boost your income. Stay consistent, learn continuously, and adapt to market changes. Your dedication and smart planning will pave the way to financial success.

Start today and see the difference in your financial future.